1 percent of the household income that is above the tax return filing threshold for the taxpayer’s filing status, or.

For tax year 2014, that payment would amount to whichever of these is greater:

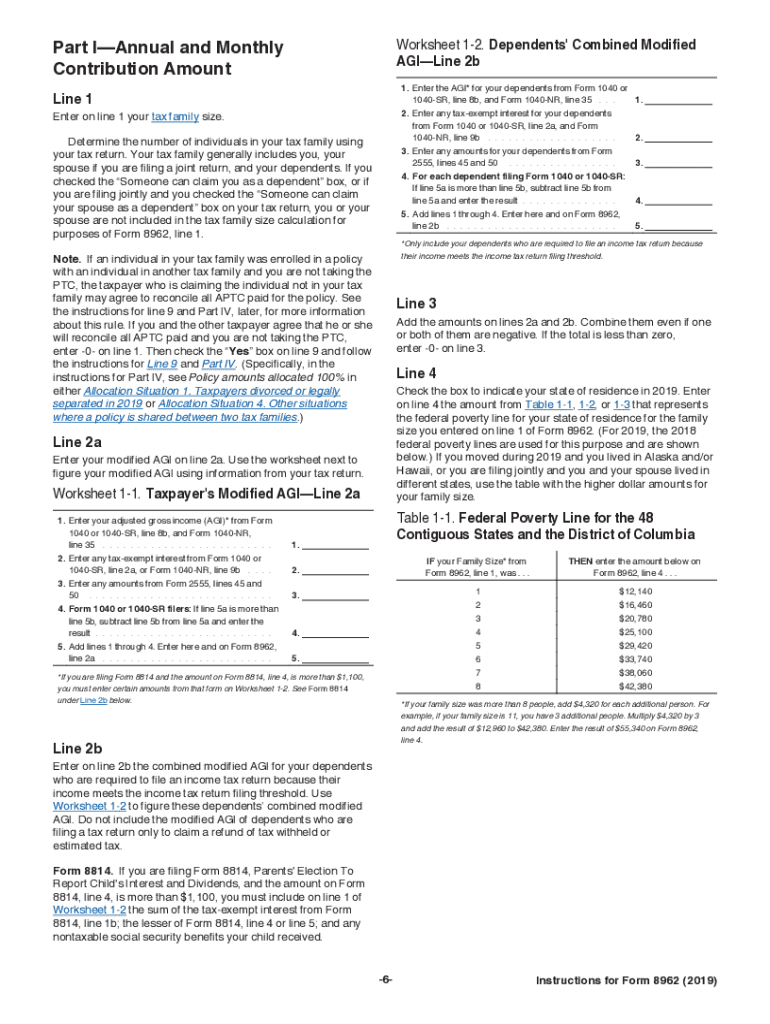

If you did not have health insurance in 2014, the IRS will assess what’s called an individual s hared responsibility payment. Warning: The Form 8962 is a complicated new form, so there is bound to be some confusion. If there is a difference between any advance credit payment made and the new, calculated Premium Tax Credit, you may receive a refund – or be required to repay the excess. To do so, fill out a Form 8962.įigure 2: You’ll need to complete a Form 8962 to see if you can claim the Premium Tax Credit.īasically, the IRS is trying to calculate the amount of tax credit you should receive. However, if your household situation changed between the estimates made during the enrollment period and your IRS income tax preparation (due to divorce, income increase or decrease, etc.), you’ll need to see if you are still eligible. Your marketplace should have notified you about your PTC status. This formula involves comparing your income to the Federal Poverty Line (FPL).

The ACA built in provisions for individuals who could not afford even a lower-tier health insurance policy – Premium Tax Credits (PTC) - to ensure that all taxpayers would be able to buy coverage. The Form 1095-A, which is issued by the marketplace, contains several types of information, including details about you, your policy, household individuals covered, your monthly premiums, and any advance credit payments you received (this would have occurred during enrollment). If you have not received it by now, contact the marketplace where you signed up for coverage don’t contact the IRS. If you bought a plan through the Health Insurance Marketplace, you should have received an IRS Form 1095-A by January 31, 2015. If you have such health coverage, all you have to do is check the “Yes” box on the new line 61 on the 2014 Form 1040.įigure 1: The 2014 IRS Form 1040 now asks about your household’s health coverage.

Individual coverage purchased through the Health Insurance Marketplace (either or your state’s exchange) or directly from an insurance company, or.Government-sponsored programs like Medicare,.That means all taxpayers were required by law to have had minimum essential coverage for all 12 months, which includes: For the first time, all taxpayers must include information about their health care coverage to the IRS on their 2014 Form 1040.Ģ014 was the first tax year that the Individual Shared Responsibility Provision (SRP) of the Affordable Care Act (ACA) went into effect.

0 kommentar(er)

0 kommentar(er)